When a fast food franchise is exploring investment in a new location or where to spend their advertising dollars, it’s critical to know the makeup of a region’s customer base. Resonate allows brands to onboard their own first-party data to enrich it with 14,000+ attributes, including insights on DMA, fast food preferences, and more. Resonate reveals consumer values, behaviors, and motivations to drive the messaging and product development that will build brand loyalty — and they can do this all on the individual and DMA level.

Today, we’re analyzing two fast food-loving groups in different DMAs to see where they have similarities and differences, and which insights could help inform a brand’s decisions to open up new locations, message target customers, and power this data into personalized action.

Want more fast food insights? Read our blog post analyzing fast food fanatics, vaccine hesitancy, and where a PSA partnership could come into play.

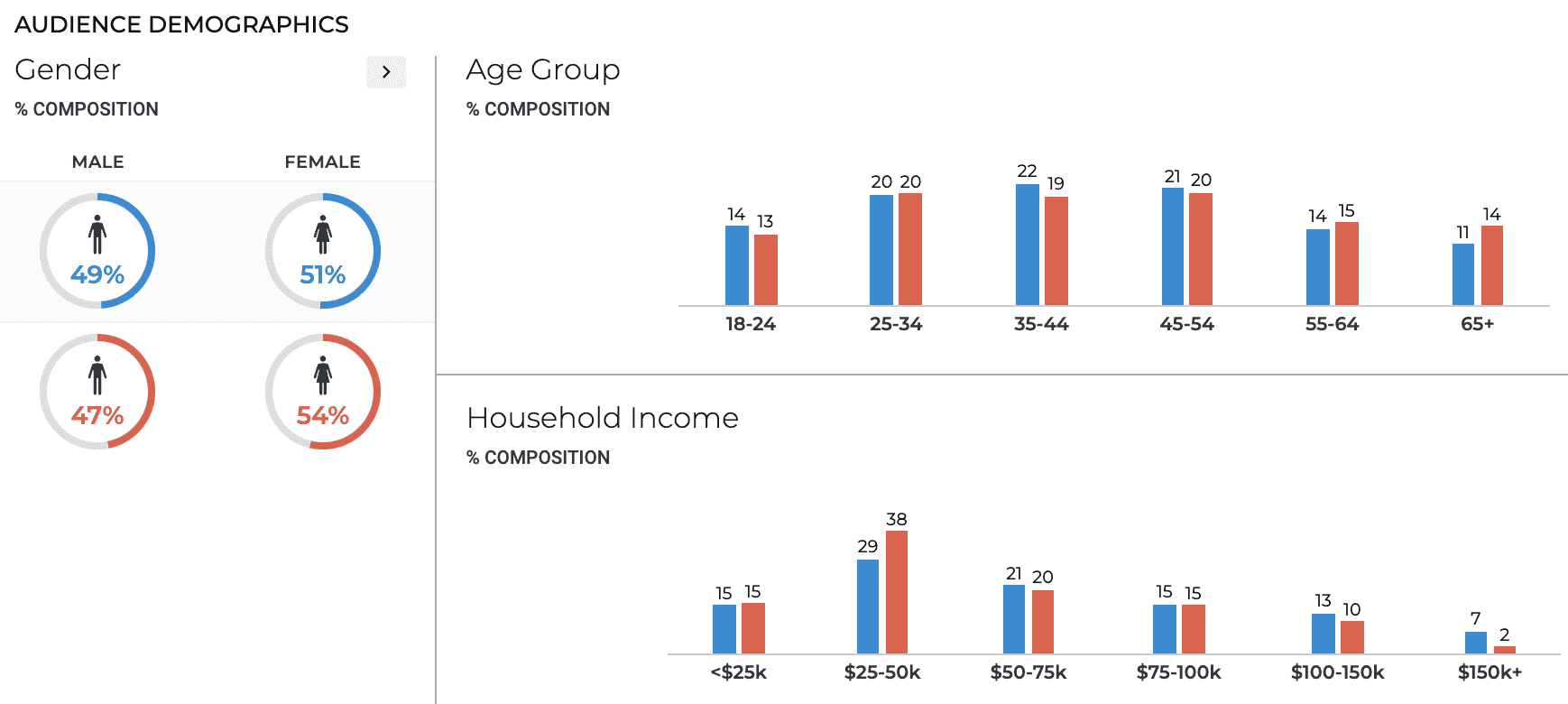

These groups are defined as consumers who eat at a fast food restaurant at least once a month. Atlanta Fast Food fans are BLUE | Nashville Fast Food Fans are ORANGE

Insight One: Atlanta Fast Food Fans are Younger, Nashville Fans are Lower Income

We know that real customer loyalty goes deeper than demographics, but it’s important to set the stage with a quick look at who these consumers are. In Atlanta, we see an almost 50-50 split of male and female fast food fans, and most customers fall within the Millennial and Gen X age groups. Nashville, however, sees more female fast food fans, more within the Baby Boomer generation, and over 50% have a household income under $50K.

Source: The Resonate Ignite Platform, February 2022

Insight Two: Both Groups Value Being Humble

Atlanta fast food fans have an upwardly mobile mindset, with dreams of acquiring wealth and influence, and maintaining a good public image. Meanwhile, Nashville fast food fans are set on maintaining traditions and being reliable and trustworthy. But, what both groups have in common is a dedicating to being humble and expressing humility. This means they want to emphasize the welfare of others, they value being modest, grateful, and generous.

Insights into action: How does humility as a value play into messaging? Think of Chick-fil-A®. Their commercials featuring “A True Chick-fil-A® Story” do this perfectly, emphasizing making sacrifices for the goodwill and benefit of others.

Source: The Resonate Ignite Platform, February 2022

Insight Three: Atlanta Fast Food Fans Care About Healthy Products

These two groups have different priorities when it comes to their purchase drivers, yet neither cares about energy-efficiency. Atlanta fast food fans want products that are innovative, healthy, and popular, while Nashville fast food fans care more about enjoyable, family-friendly, and fun and exciting products.

Insights into action: When advertising in Atlanta, focus on healthy menu options and stay on top of trending culinary items. Meanwhile, in Nashville, emphasize options for the whole family or family-friendly dining accommodations.

Source: The Resonate Ignite Platform, February 2022

Insight Four: Both Groups Care About Convenience and a Break from Cooking

Why do fast food fans hit the drive through? Most are motivated by convenience, as well as getting a break from cleaning. One in four customers in each group considers fast food a treat, and others resort to fast food when traveling away from home.

Insights into action: Both groups cited that they’re less likely than the average consumer to consider coupons a motivating reason to spring for fast food, so don’t waste your advertising dollars on coupon campaigns.

Source: The Resonate Ignite Platform, February 2022

Insight Five: These are Frequent Diners

The criteria for this group was set at diners who ate fast food at least once in the past month, but it became clear that if you dine once, you dine several times.

Insights into action: Both groups are more likely than the average consumer to indicate that a tiered loyalty program or loyalty discounts based on the amount spent are factors in their fast food decisions. Prioritize loyalty rewards to keep these consumers coming back.

Source: The Resonate Ignite Platform, February 2022

Insight Six: Atlanta Fast Food Fans Can’t Get Enough Chick-fil-A®

With all these insights in mind, it’s time to look at where these fast foods are spending their dollars. Atlanta fast food fans love that spicy chicken and “My pleasure” attitude of Chick-fil-A®, while Nashville is living mas with Taco Bell®. Interestingly, both groups are less likely than the average consumer to eat at McDonald’s or Southern staple Bojangles’.

Insights into action: When you know what customers prefer, you know what to give them more of.

Source: The Resonate Ignite Platform, February 2022

Ready to See These Insights on Your Customers?

Whether you’re a fast food company or any brand or agency looking for deeper, fresher, more personalized data, Resonate has 14,000+ insights scaled to 230 million U.S. consumers ready to enrich your understanding. Request a demo today to get started.