Where did 2022 go? We’re only a few sleeps away from the new year, which means now is the perfect time for trend-watching. At Resonate, we’re all about what’s next in the world of consumers—and, particularly, Connected TV. Here are 3 big Connected TV trends streaming companies will want to watch in 2023.

A Focus on Data-Driven Content Strategies

We’re living through tough economic times. Audience churn will be a challenge in the CTV world next year, as viewers cycle through services by subscribing and unsubscribing until the next must-see content arrives on a platform.

OTT platforms have access to owned audience data on what consumers are watching within their networks, as well as when and how they’re watching. And while there’s tremendous room for more robust audience insights, the data they have now can allow streaming platforms to deploy data-powered content strategies that are more likely to resonate well with viewers.

Resonate predicts we’ll see growth in streaming companies’ audience enrichment strategies to enhance cross-channel digital content distribution and eliminate the gaps in subscriber acquisition and retention. By shifting a focus on strategic audience data enrichment—audience sentiment, churn signals, etc.—streaming services have the power to personalize their campaigns towards avid viewers, inconsistent viewers, or viewers who are at risk of jumping ship.

CPG Brands Flock to Connected TV

Speaking of advertisers making money moves towards more CTV-focused marketing strategies, marketers predict we’ll see more consumer-packaged goods companies do just that. According to a recent Ad Age article, CPG’s video impression share for CTV was 52%, up from 44%. CPG advertisers are continuing to shift their budgets from linear TV to CTV to improve reach among younger audiences that can’t be reached on linear.

Because most CPG brands use third-party purchase data, which provides purchase information but lacks insight into their buyers, streaming providers should be prepared for this boom by looking at their own first-party data and insights to attract these retailers.

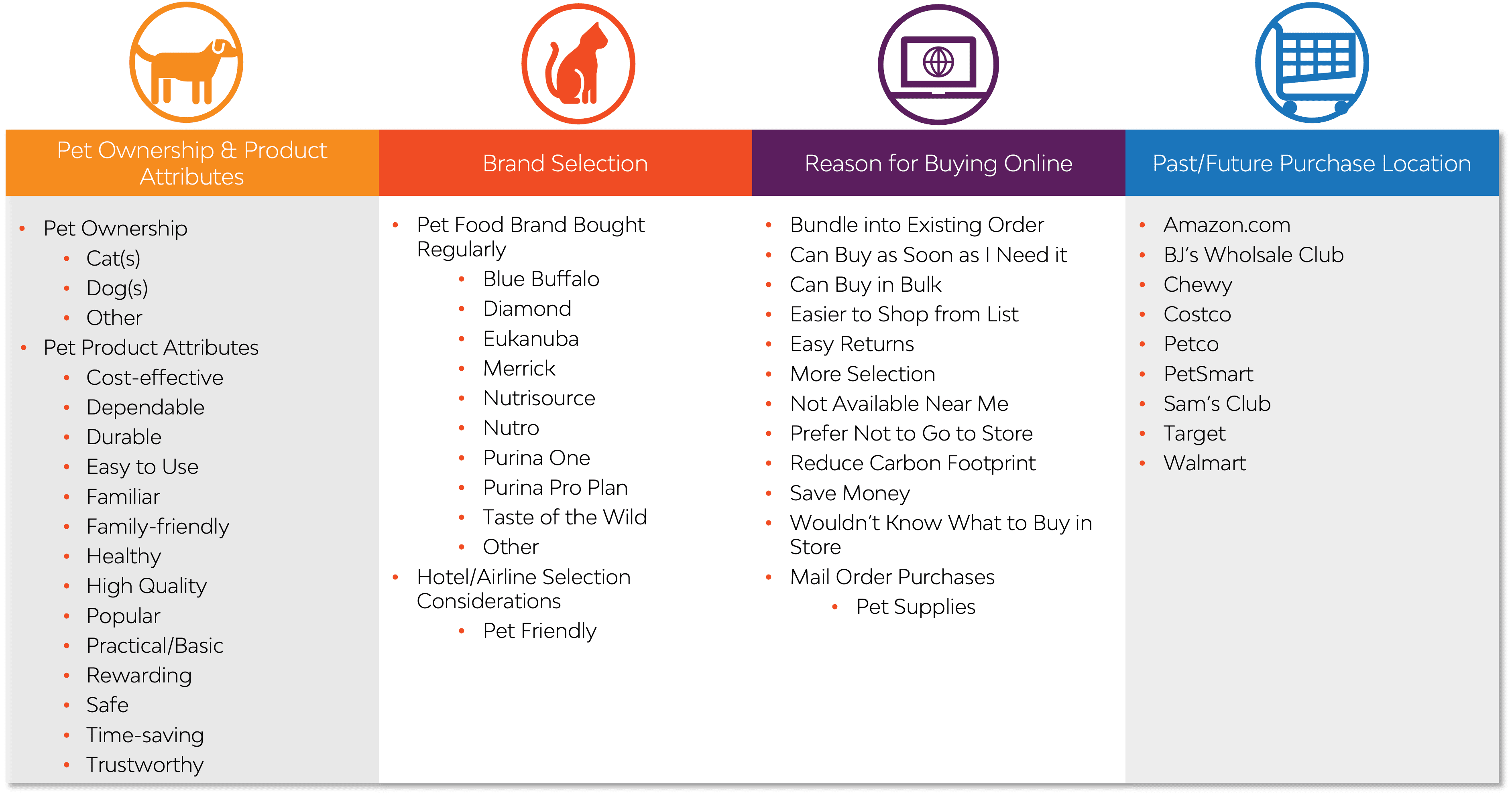

For example, the same Ad Age article mentioned above lists pet supply brands as the leaders in CTV impression share. Streaming providers who use the AI-powered Resonate Ignite Platform to enrich their first-party audience data have access to insights brands like Purina and Blue Buffalo will want to know:

This leads us to the last of our Connected TV trends: advertisers will be leaning on media companies more heavily for audience insights in 2023.

Advertisers’ Growing Need for a Consultative Approach

We’ve had a few years of immense growth in the streaming world, with advertisers moving away from linear in droves to reach today’s cord-cutters and cord-nevers. But this CTV boom also exposed some issues with advertising on the channel, like inventory fragmentation. With this economic downturn, we predict advertisers will focus on channel diversification in 2023 and follow their target audiences more closely wherever they’re watching.

For streaming providers, this can be an incredible opportunity to become their advertisers’ strategic partners by offering unique value to conversations in the acquisition and retention stages around their target audiences.

Advertisers want to know more than ‘Who’s watching.’ They want to validate and negate their CTV hypotheses before making major investments or shifting money from other advertising channels to CTV. At Resonate, we’ve had pointed conversations with brands and their advertisers regarding what audience insights they want to gauge. Below are some of our most frequently asked questions:

- Which audiences can they stop linear for and go all in with CTV?

- Which audiences are hybrid where they must do both CTV and linear?

- What streaming channel should they go with (Hulu or Amazon) based on their target audiences? Is there relevant data at the show-level?

- What provider has people who binge watch shows? Do these audiences have multiple subscriptions?

Secure A Winning 2023 CTV Strategy with Resonate

If you want to get ahead of these Connected TV trends, you’ll need to have a data-focused strategy. Resonate’s CTV Insights unlock an unprecedented level of insights into your own Connected TV audiences in a cookieless environment, allowing you to enrich your understanding of your streaming viewers using thousands of descriptive and predictive insights available within the Resonate proprietary, cookieless data set.

With our solution, you can expand your understanding of who today’s cord-cutters are at the household level, what matters to them, where to find them, and when or why they make the decisions they make through insights across all key advertiser industries—including Retail, Financial Services, Consumer Packaged Goods, Direct-to-Consumer Brands, Insurance, Technology, Travel & Hospitality, Food & Beverage and more.

Want to learn more about Resonate’s scalable, AI-powered CTV Insights? Talk to us.