21% of Americans use online-only banking. And, of the 140 million who use a traditional bank, less than 50% primarily use its services in person. With digital banking on the rise, bank marketers need deep, up-to-date insights on their customers and prospects – particularly ones who are itching to switch banks. Having unparalleled data at the ready helps all aspects of marketing, from predictive modeling to product design and crafting creative and offers.

Using Resonate’s robust, real-time data points, we constructed an audience of bank switchers eager to go digital. Let’s look at traditional bankers who are planning to switch banks in the next year and:

- don’t care about convenient branch locations,

- have mobile and online banking as their top considerations when choosing a bank, or

- cite “better online/mobile banking services” as a top reason to switch.

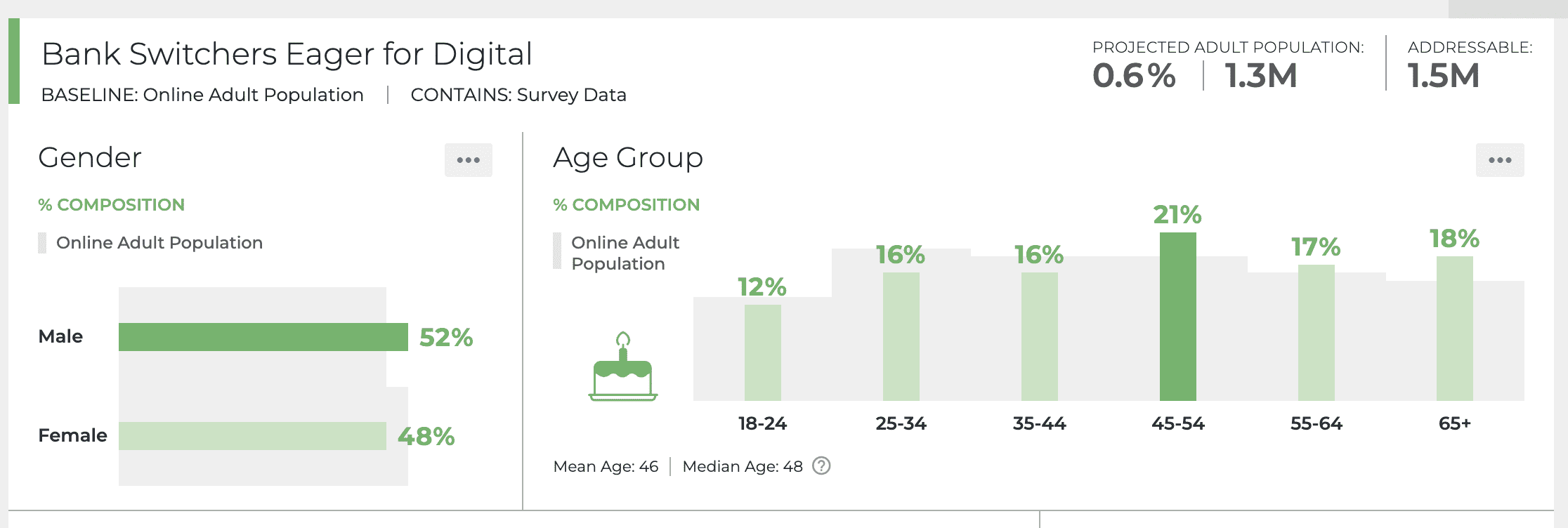

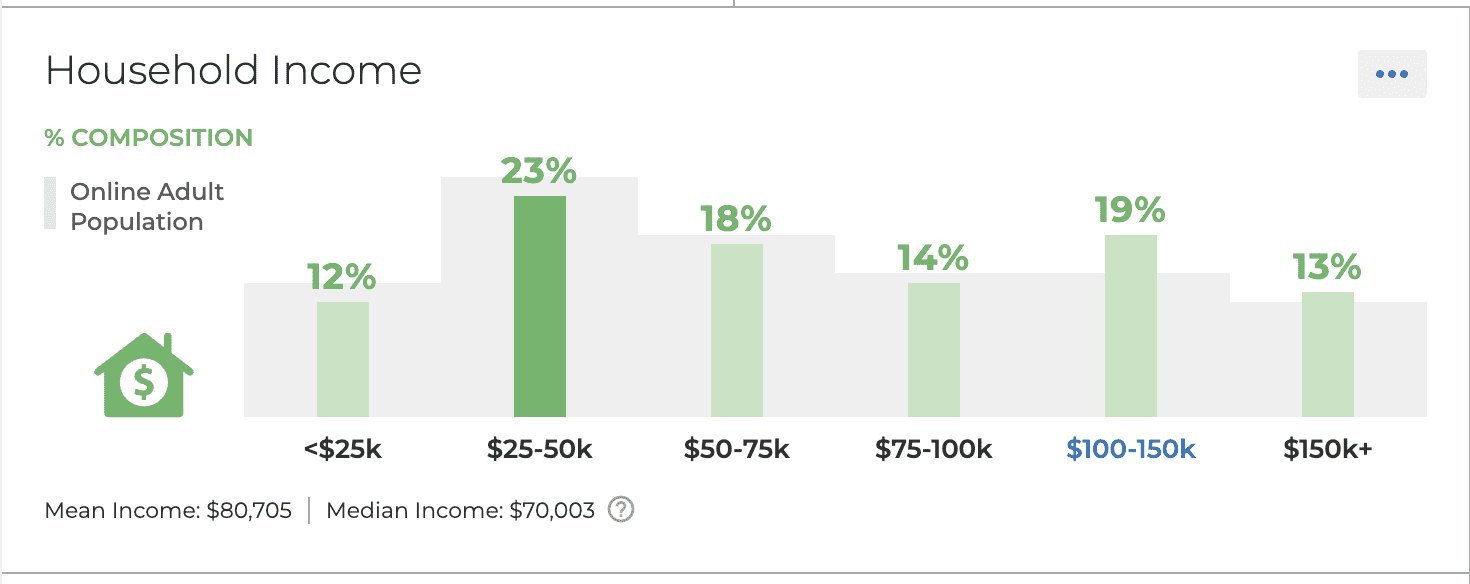

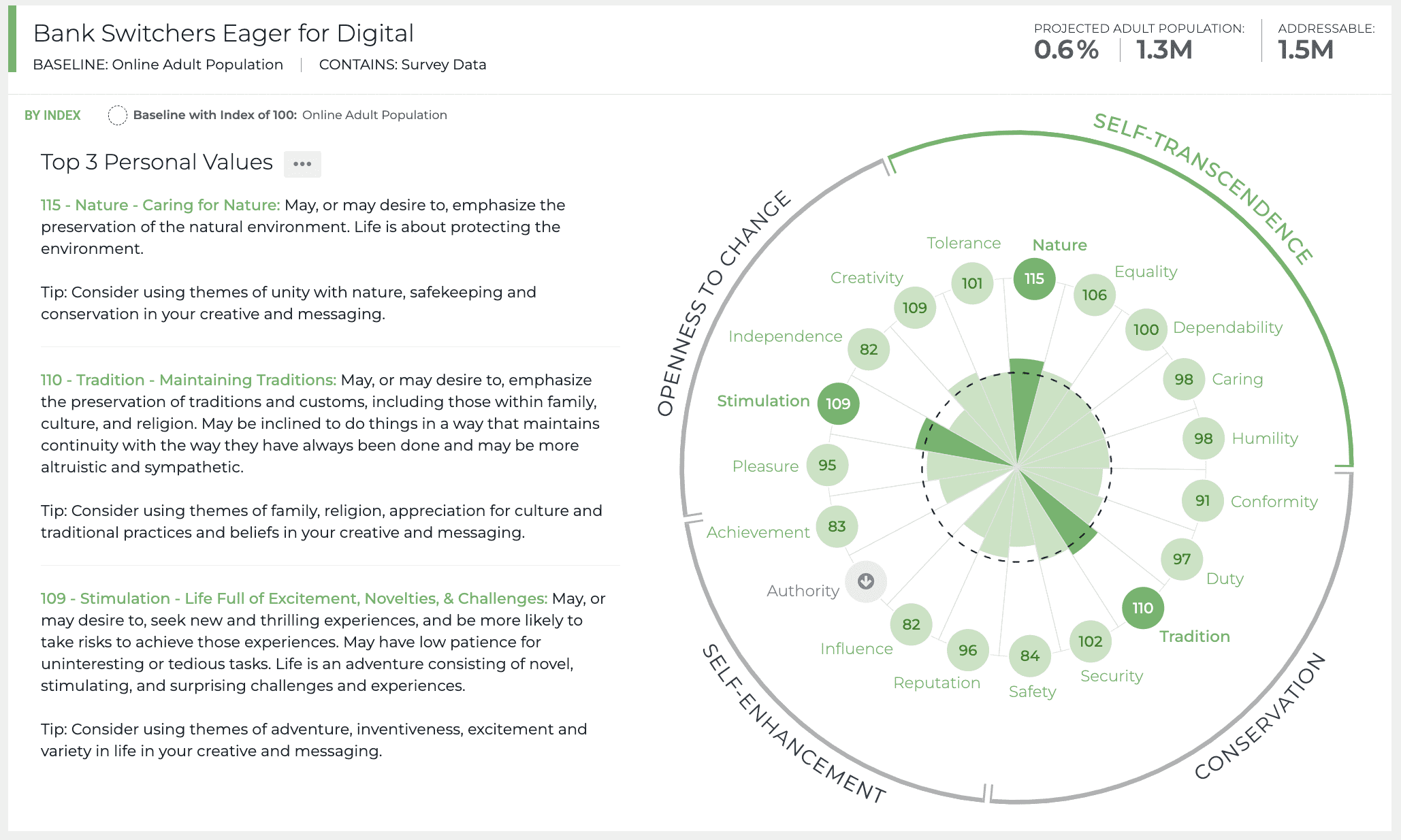

Using these parameters, we found this audience is made up of 1.3 million adults, with 1.5 million directly addressable across digital channels (see how).

Source: Resonate Ignite, March 2023

5 Things to Know About Bank Switchers with an Eye on Digital Banking

Now that we have our audience, let’s get to know them on a deeper level and figure out what messaging, offers and creative may best appeal to them.

1. Digital banking is #1, #2 is…

After mobile or online banking, this audience’s #2 consideration when selecting a bank is still having access to an ATM. They care least about having access to free checking or saving on banking fees.

2. The personal values driving their decisions are…

Resonate’s unique data goes beyond basic demographics and psychographics to reveal the “why” behind Americans’ decisions, including personal values. Consciously or not, our values influence our opinions and behaviors. The top values of bank switchers with an eye on digital banking are caring for nature, maintaining traditions and living an exciting life. How can you emphasize these themes in your advertising to this audience?

Source: Resonate Ignite, March 2023

Understanding your audience’s values helps you connect with them on a deeper level and strengthens your chances of making an impact.

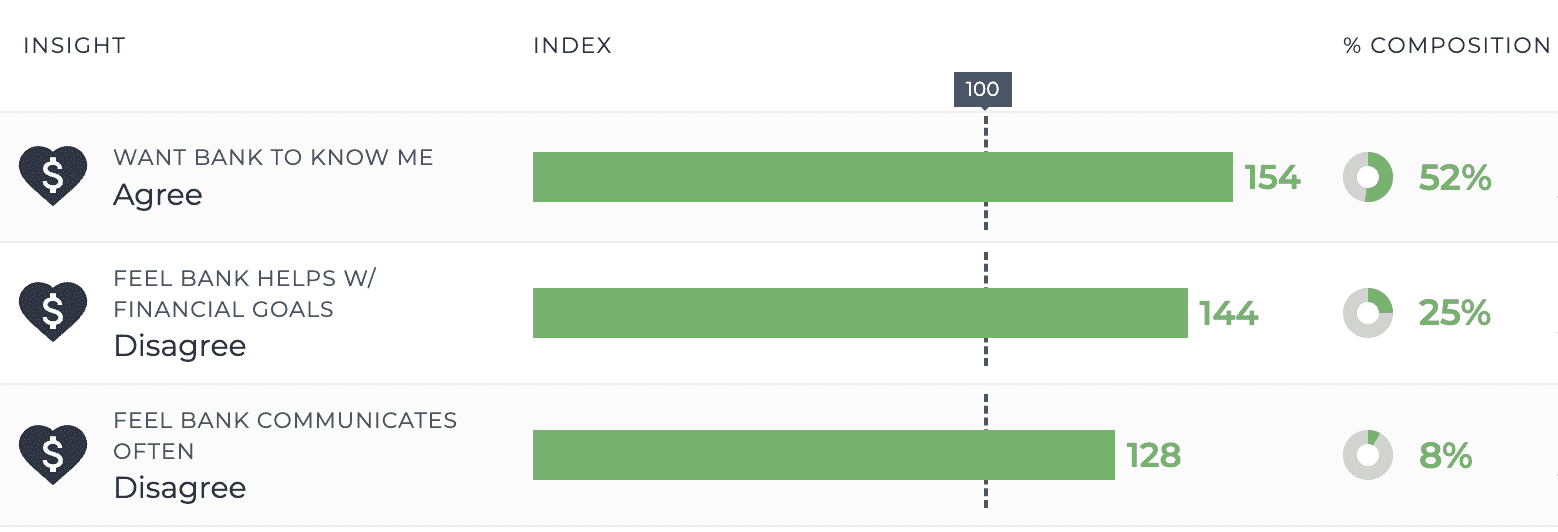

3. The psychographics behind their banking choices are…

Personal values underpin this audience’s EVERY decision, but what about their BANKING decisions in particular?

Source: Resonate Ignite, March 2023

4. The top task they’d use digital banking for…

- 54% would use digital banking to initiate a loan

- 43% are likely to use digital banking for budgeting

Interestingly, 70% are less likely to check their balances and conduct transactions online than the average US consumer. Perhaps these digital-eager folks may still value good ol’ pen and paper for some day-to-day tasks.

5. They’re spending their money on…

Here are some “fast facts” on the activities and items these pro-digital bank switchers are using their cash for compared to the average American. They are most likely to purchase products that are cost-effective and sustainable, and:

- 114% more likely to enjoy watching spectator sports

- 121% more likely to have an Apple TV+ subscription

- 28% more likely to have a physically active family

Get a Complete View of the US Banking Market

Banks have access to rich first-party data sets that allow them to understand customer transactions. But this data alone doesn’t provide them with the insight they need to engage today’s consumers and drive growth.

Resonate Banking data helps banks create a holistic picture of banking customers, revealing what drives them, what products they want, if they plan to switch banks (and why) and much more. Institutions can pull from 248 privacy-safe, up-to-date banking data attributes combined with thousands of other unique data points that paint the complete picture of humans in your audience to execute better marketing from acquisition to retention.

Learn more about Resonate Banking here.