Who is the most anxious about personal finance issues, including 401K withdrawal, unemployment and bankruptcy?

From the stock market to record unemployment claims, we know that the impact of COVID-19 on personal finance is substantial.

But, what does that mean on an individual level? How does that affect those Americans that make up your customers or prospects? What are they feeling from their bank accounts to their wallets and beyond? And, how should you be speaking to your consumers?

Personal Finance Searches During the Coronavirus Crisis

As we researched the impact of COVID-19 on personal finance, we analyzed roughly 10 billion daily online events and used AI and predictive modeling to scale these insights to 200 million U.S. consumers. We saw that there were four primary personal finance search buckets:

- Investigating unpaid leave and unemployment

- Investigating personal bankruptcy

- Investigating 401k withdrawal and penalties

- Investigating money saving strategies

Looking at those four buckets, we can analyze the audiences that are searching for these particular topics to identify differences within those groups.

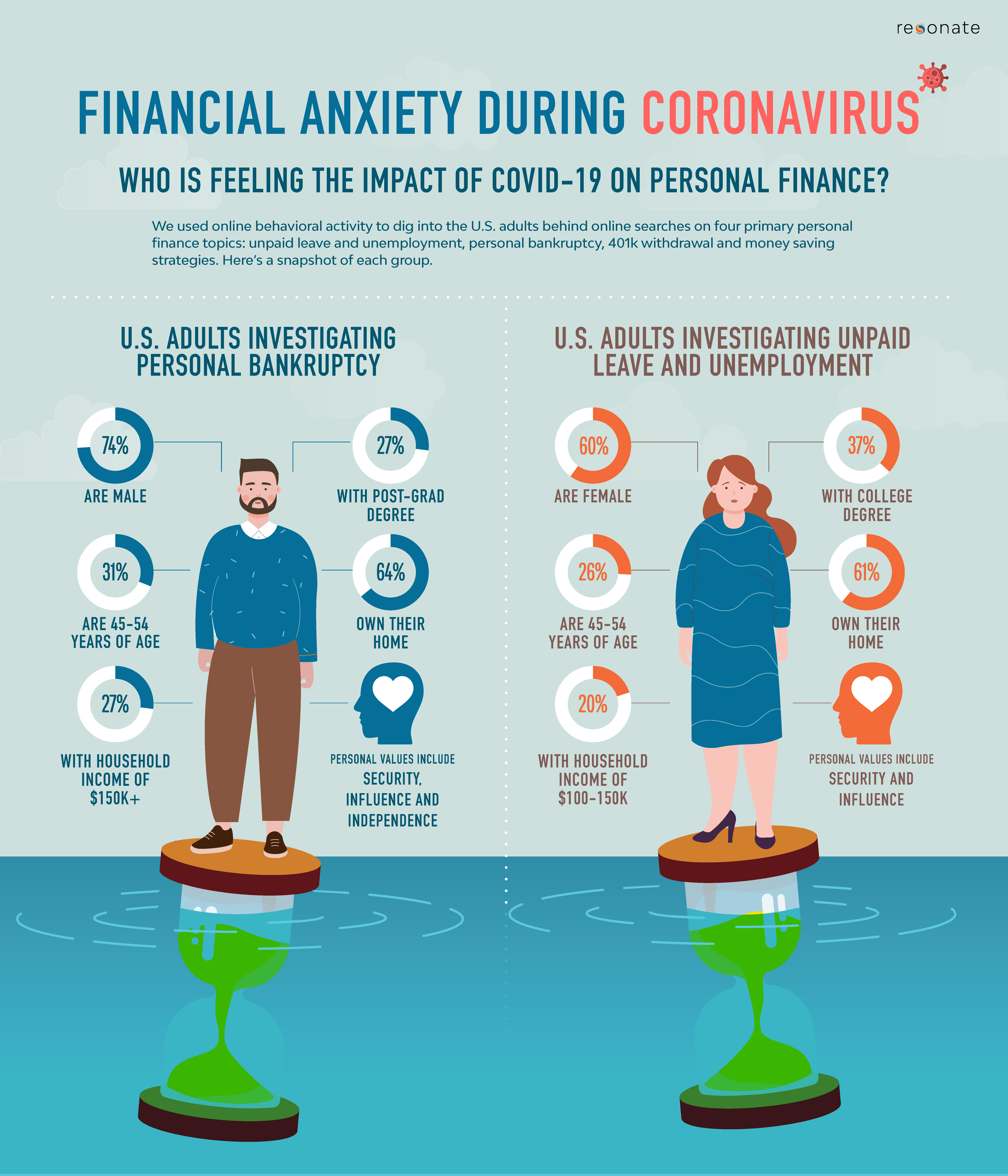

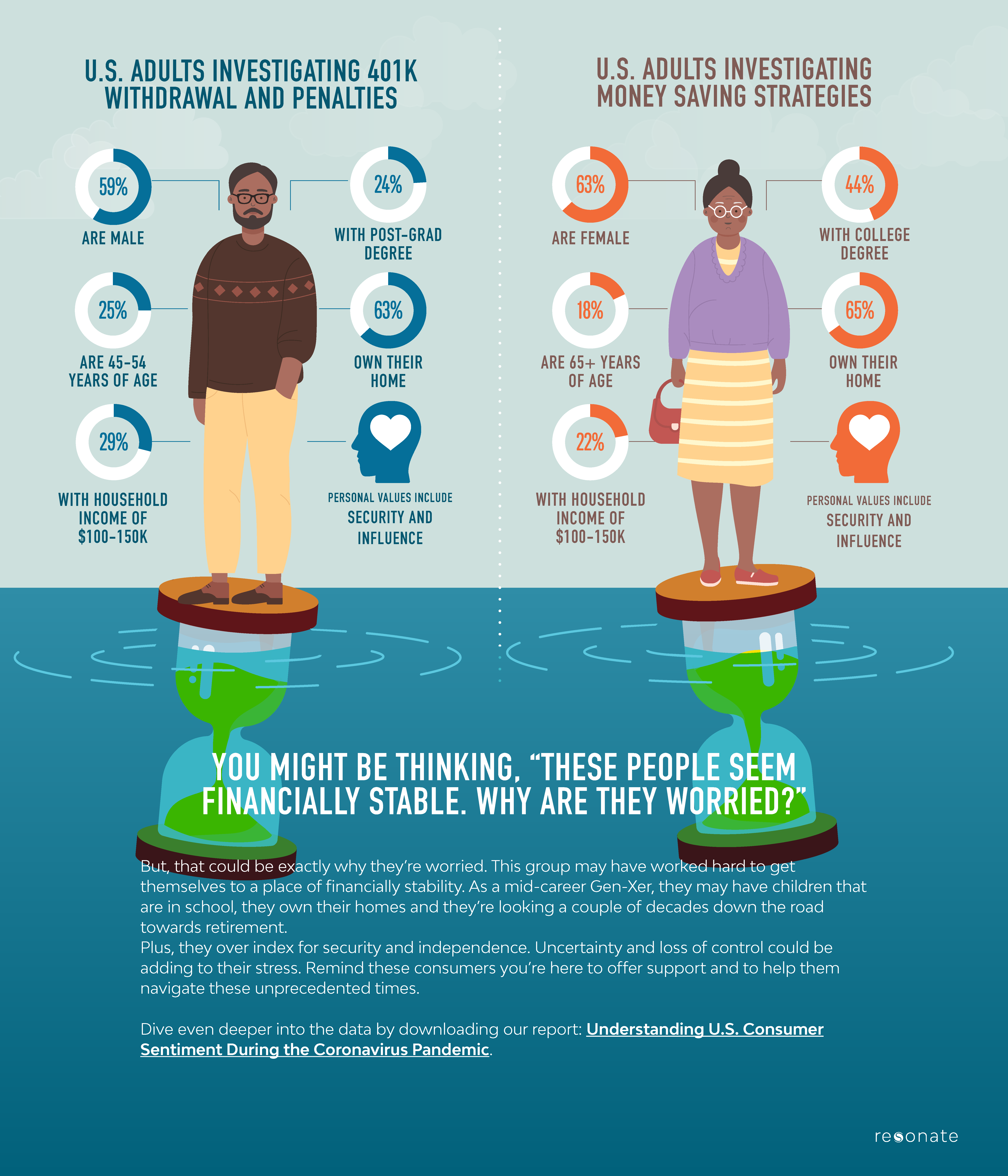

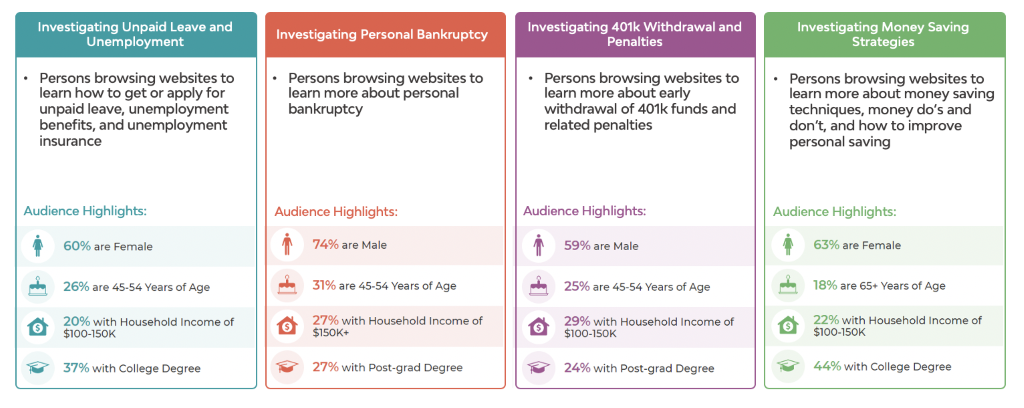

As you can see in the chart above, those investigating unpaid leave and unemployment benefits/insurance, are 60% female and 26% of those are 45-54 years of age. 37% have a college degree and 20% have a household income between $100-150K.

Those researching personal bankruptcy are 74% male, 27% with a household income of $150K and a post-grad degree, and 31% between 45-54 years of age.

When it comes to those individuals browsing websites to research early withdrawal of 401K funds and subsequent penalties, 59% are male, 25% are 45-54 years of age, 29% have a household income between $100-150K, and 24% have a post-grad degree.

And, those researching online to learn more about money saving techniques and how to improve personal savings, 63% are female, 18% are 65+ years of age, 22% have a household income between $100-150K, and 44% have a college degree.

If any of these demographic groups fall within your target audience, it’s important to draw in empathy in your communication, marketing and outreach. These groups, while they are making strides to prepare for an uncertain future, they may be experiencing stress and anxiety.

Think about how your brand or company can offer help or support during this time. Consider whether you can reposition your messaging with an angle of comfort and certainty. An acknowledgement of their feelings goes further than continuing to operate as though nothing has changed.

Who is the Most Anxious About the Impact of COVID-19 on Personal Finance?

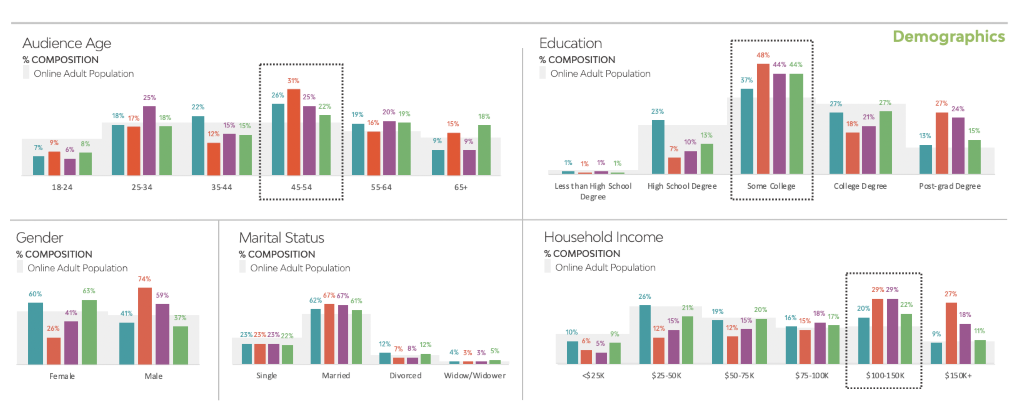

When we analyze searches for these same buckets and look to create a view of who is the most anxious about the impact of COVID-19 on personal finance, we see a 360-degree picture of a human begin to develop.

There are significant groups that emerge in each area showing us that this person who is most anxious about personal finance could look like this:

- 45-54 years old

- Some college

- Married

- $100-150K household income

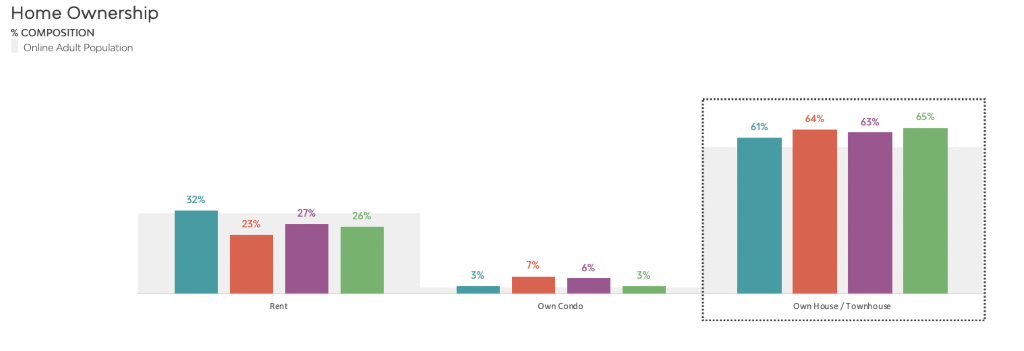

- Homeowner

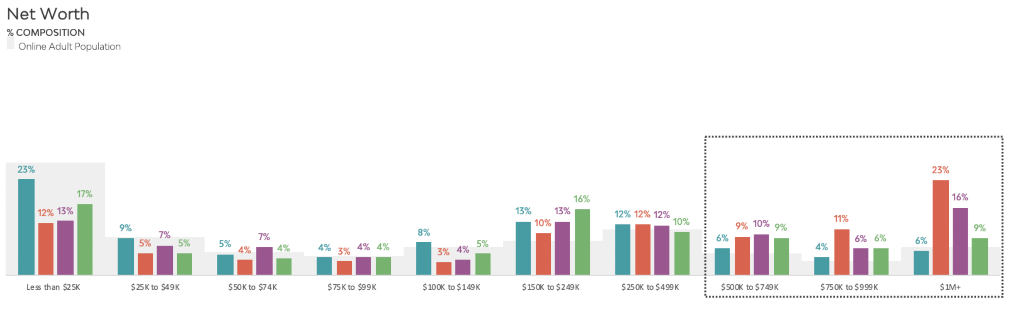

- Networth of over $500K

Speaking to Consumers Who Are Anxious About Personal Finance

At first glance, we might think, “This person seems fairly financially stable. Why are they worried?” But, perhaps, that’s exactly why they’re worried. This group may have worked hard to get themselves to a place of financially stability and they feel invested in maintaining their position. As a mid-career Gen-Xer, they may have children that are in school, they own their homes, and they’re looking a couple of decades down the road towards retirement.

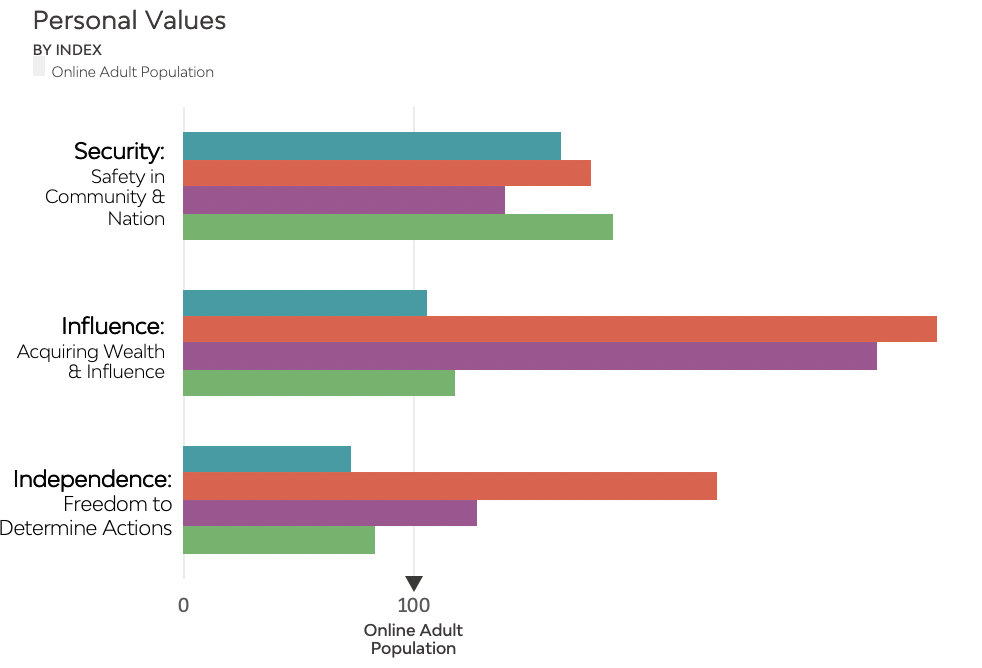

This group’s anxiety becomes even more clear when we look at the values that they over index for, which include security and independence. It’s the uncertainty and loss of control that could be adding to their stress which means we’re back to the idea of featuring empathy as a key element in messaging. Remind these consumers you’re here to offer support and to help them navigate these unprecedented times.

How Do We Source Our Data?

Curious about how we’re sourcing these insights about the U.S. Consumer in real-time during the Coronavirus crisis? This data is drawn from Resonate’s National Consumer Study, which includes contextual analysis on the impact of COVID-19. This data is tied to the online digital behaviors of over 500 million devices by leveraging AI & predictive modeling to predict the survey responses of the individuals using these devices. With more than 100 questions and 5,000 respondents on COVID-19 there is industry coverage from finance to travel, politics, entertainment, media, retail and more.

Resonate provides approximately 200 million human profiles featuring 13,000+ elements to reveal the deepest understanding of US consumers.

This audience analysis includes baseline comparisons between highlighted audiences and the online adult population.

Dive even deeper into the data by downloading our just released report: Understanding U.S. Consumer Sentiment During the Coronavirus Pandemic.

Categorized as: Blog Page, Consumer Insights, COVID-19 Insights